20 Best Medical Cards in Malaysia 2024

Private hospitals in Malaysia will normally require a deposit before they admit you. This can usually be paid by cash, debit card or credit card. However, if you have a medical card, most private hospitals will accept admission without the deposit (cashless admission), after receiving the guarantee letter from the medical insurance company.

If you do not have a medical card, you might want to consider having one. Given the options available, it's not easy to decide which of these to choose from.

WEBSITE: www.aia.com.my

This plan is only available for Malaysian citizens residing in Malaysia.

This plan is commission-free and no intermediaries are involved in the sales or marketing of AIA Med Basic.

WEBSITE: www.prudential.com.my

ADDRESS: Ground Floor, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur

CONTACT DETAILS: 03 2116 0228

OPERATING HOURS: Mon-Fri 8:30am – 5:15pm

WEBSITE: online.takaful-malaysia.com.my

ADDRESS: 14th Floor, Annexe Block, Menara Takaful Malaysia, No. 4, Jalan Sultan Sulaiman, 50000 Kuala Lumpur P.O. Box 11483, 50746 Kuala Lumpur.

CONTACT DETAILS: 1300 820031

OPERATING HOURS: Mon-Thurs 8:30 am – 5:00 pm, Fri 8:30 am – 4:30 pm

The Takaful myClick MediCare Medical Card is the first-ever fully underwritten online medical plan in Asia.

Takaful Malaysia medical card panel hospitals: Click here

WEBSITE: https://www.greateasternlife.com/my/en/personal-insurance/our-products/health-insurance.htmlADDRESS: Menara Great Eastern, 303 Jalan Ampang, 50450 Kuala Lumpur

CONTACT DETAILS: 1300-1300 88

OPERATING HOURS: Monday to Friday 8:30am to 5:15pm

If you do not have a medical card, you might want to consider having one. Given the options available, it's not easy to decide which of these to choose from.

We take a look at the most popular medical cards in Malaysia and try to assist you in deciding which gives you the best value.

|

| Source: The Star Online, "Planning for healthcare costs in retirement", 4 October 2015 |

Compare best medical cards offering cashless admissions with flexible benefits and paying 100% of your medical bills, from major insurers in Malaysia.

Here is the list:

Here is the list:

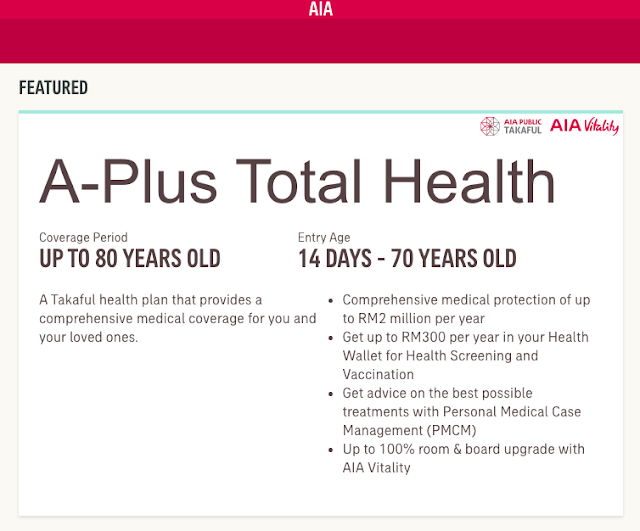

AIA Medical Card Malaysia

WEBSITE: www.aia.com.my

ADDRESS: Menara AIA, 99 Jalan Ampang, 50450 Kuala Lumpur

CONTACT DETAILS: 1300-88-1899

CONTACT DETAILS: 1300-88-1899

OPERATING HOURS: Mon-Fri 8:30am-4:30pm

AIA A-Plus Health Medical Card

Room & Board: up to RM500

Annual Limit: up to RM2m

Lifetime Limit: No limit

AIA A-Plus Med Medical Card

Room & Board: up to RM500

Annual Limit: up to RM260k

Lifetime Limit: No limit

AIA A-Life Med Regular Medical Card

Room & Board: up to RM250

Annual Limit: up to RM150k

Lifetime Limit: Not applicable

AIA Med Basic

AIA Med Basic provides you with coverage for medical treatment and hospitalisation at an affordable and cheap price. This plan is suitable for you if you are looking for basic medical coverage. You can purchase AIA Med Basic directly online and be protected immediately.This plan is only available for Malaysian citizens residing in Malaysia.

This plan is commission-free and no intermediaries are involved in the sales or marketing of AIA Med Basic.

Room & Board: Reimbursement up to RM100 per day for your room and board for a maximum of 120 days per year.

Annual Limit: The maximum eligible medical expenses payable by AIA is RM20,000 annuallyLifetime Limit: up to RM80,000

Prudential Medical Card Malaysia

WEBSITE: www.prudential.com.my

ADDRESS: Ground Floor, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur

CONTACT DETAILS: 03 2116 0228

OPERATING HOURS: Mon-Fri 8:30am – 5:15pm

Prudential PRUValue Med Medical Card (Rider)

Room & Board: up to RM600

Annual Limit: Not applicable

Lifetime Limit: Not applicable

Prudential PRUMillion Med Medical Card (Rider)

Room & Board: up to RM500

Annual Limit: up to RM2m

Lifetime Limit: Not applicable

Prudential PRUsenior med Medical Card

Room & Board: from RM200

Annual Limit: Not applicable

Lifetime Limit: up to RM225k

Prudential PRUHealth Medical Card

Room & Board: up to RM600

Annual Limit: up to RM250k

Lifetime Limit: up to RM2.6m

PRUMillion Med vs PRUValue Med

PRUMillion Med is a newer medical plan as compared to PRUValue Med. PRUValue's weaknesses of standalone lifetime limit for outpatient cancer & kidney dialysis makes it unfavorable among the other options available now.According to an answer on Lowyat.net:

Major differences is that PMM has an annual limit of RM1.38m (with higher insurance charges naturally) as compared to PVM. For PVM, if one is able to claim up to RM1M cummulative, Prudential will pay 80% of the bill, whilst client has to pay 20%.

Cancer treatment and kidney dialysis is claimable up to RM1.5M for PVM as compared to PMM that has an annual limit of RM1.38M.

Cancer treatment and kidney dialysis is claimable up to RM1.5M for PVM as compared to PMM that has an annual limit of RM1.38M.

Takaful Medical Card Malaysia

WEBSITE: online.takaful-malaysia.com.my

ADDRESS: 14th Floor, Annexe Block, Menara Takaful Malaysia, No. 4, Jalan Sultan Sulaiman, 50000 Kuala Lumpur P.O. Box 11483, 50746 Kuala Lumpur.

CONTACT DETAILS: 1300 820031

OPERATING HOURS: Mon-Thurs 8:30 am – 5:00 pm, Fri 8:30 am – 4:30 pm

The Takaful myClick MediCare Medical Card is the first-ever fully underwritten online medical plan in Asia.

Takaful myClick MediCare Medical Card

Room & Board: up to RM200

Annual Limit: up to RM100k

Lifetime Limit: Not applicable

Takaful myHealth Protector Medical Card

Room & Board: up to RM500

Annual Limit: up to RM275k

Lifetime Limit: No limit

ADDRESS: Level 29, Menara Allianz Sentral, 203, Jalan Tun Sambanthan, Kuala Lumpur Sentral, 50470 Kuala Lumpur.

CONTACT DETAILS: 1300 22 5542

OPERATING HOURS: Mon-Fri 8:00 am – 8:00 pm

CONTACT DETAILS: 1300 22 5542

OPERATING HOURS: Mon-Fri 8:00 am – 8:00 pm

Allianz MediAdvantage Medical Card

Room & Board: As Charged

Annual Limit: up to RM8m

Lifetime Limit: up to RM16m

Allianz Diabetic Essential Medical Card

Room & Board: up to RM400

Annual Limit: up to RM1.4m

Lifetime Limit: up to RM4.2m

Allianz Booster Care Medical Card

Room & Board: As Charged

Annual Limit: up to RM200k

Lifetime Limit: RM1m

Allianz Care Individual Medical Card

Room & Board: up to RM400

Annual Limit: up to RM125k

Lifetime Limit: Not applicable

Allianz MediSafe Infinite+ Medical Card

Room & Board: up to RM500

Annual Limit: up to RM2.5m

Lifetime Limit: No limit

ADDRESS: Menara Chulan, 3, Jalan Conlay, 50450 Kuala Lumpur.

CONTACT DETAILS: (+603) 2170 8282

OPERATING HOURS: Mon to Fri: 8.30am to 5.30pm

AXA Medical Card Malaysia

CONTACT DETAILS: (+603) 2170 8282

OPERATING HOURS: Mon to Fri: 8.30am to 5.30pm

AXA Affin eMedic Medical Card

Room & Board: up to RM250

Annual Limit: up to RM100k

Lifetime Limit: No limit

AXA eMedic is one of Malaysia’s first standalone comprehensive and affordable or cheap online medical card designed especially for young adults to have easily accessible protection against the inflation of medical fees.

AXA Affin SmartCare Optimum Plus Medical Card

Room & Board: up to RM500

Annual Limit: up to RM2.1m

Lifetime Limit: Not applicable

AXA Affin SmartCare Optimum Medical Card

Room & Board: up to RM500

Annual Limit: up to RM500k

Lifetime Limit: Not applicable

Great Eastern Medical Card Malaysia

WEBSITE: https://www.greateasternlife.com/my/en/personal-insurance/our-products/health-insurance.html

CONTACT DETAILS: 1300-1300 88

OPERATING HOURS: Monday to Friday 8:30am to 5:15pm

Great Eastern Smart Medic Medical Card

Room & Board: up to RM400

Annual Limit: up to RM200k

Lifetime Limit: up to RM2m

Great Eastern Smart Extender Max Medical Card

Room & Board: up to RM400

Annual Limit: up to RM2m

Lifetime Limit: No limit

Comments